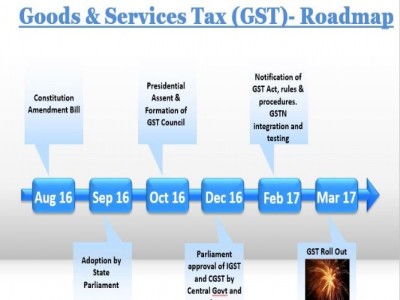

Road to rollout of Goods and Services Tax (GST) in India

On: August 19, 2016

in News

After ten years of sustained efforts, the GST Constitution Amendment bill was passed by Rajya Sabha on 03rd August. Before final assent by the lawmakers who voted on it clause by clause, there was an intense debate of seven hours. Now the bill would be sent to Lok Sabha for approval of revisions made. With this, the government has set up an ambitious target of rollout by 01st April 2017.

For this to happen, the government needs to push its machinery in action and have set following roadmap for rollout:-

- Passage of Constitution Amendment bill from Parliament: August 2016

- Ratification by 50% states. Minimum 15 state governments have to call a special session of their parliament and approve the constitution amendment bill before it could be sent for Presidential assent.

- Presidential assent of constitutional and notification in the official gazette.

- Formation of GST Council. GST Council within 60 days will make recommendations to the Union and the States on model Goods & Service Tax laws, the rates including floor rates with bands of goods & service tax, the Place of Supply rules and matters relating to GST as the Council may decide. (Draft GST law already in public domain since June 2016).

- Recommendation of model GST laws and procedures by GST council.

- Cabinet approval for the CGST and IGST laws by Centre.

- Cabinet Approval for SGST laws by respective states.

- Establishing Goods and Services Tax Network (GSTN) at Centre and State level.November 2016

- Passage of CGST and IGST laws in the Centre and passage of SGST laws in states:Winter Session (December 2016)

- Notification of GST Rules

- Testing and integration of GSTN frontend & backend processes with various stakeholders. January 2017

- Training on GST laws and GSTN to tax officers of State and Central government.

- Sensitisation of the trade associations, bodies and industries.

- Roll out. 01st April, 2017

(By Amit Mittal, Director DMH Business Advisors)

Comments